2017

PA Debt Collection Laws: What You Should Know

Student Loan Lawyer / 0 Comments /

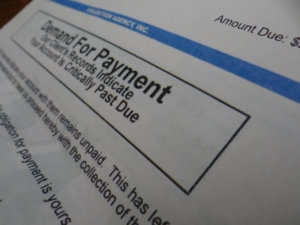

Both the federal government and the State of PA have debt collection laws to protect debtors’ rights. The laws, of course, won’t absolve you of your debts, but they do impose strict practices for parties that collect debts. According to federal and PA debt collection laws, debt collectors may not be deceptive, abusive, threatening or unfair.

What are the Debt Collection Laws in PA?

In PA, debt collection laws are almost identical to the federal laws, except in Pennsylvania the laws protect debtors from both creditors and the collection agencies, i.e. the people you owe money to and the people who are hired to collect the debt.

So what exactly are debt collectors prohibited from doing under the Fair Debt Collection Practices Act (FDCPA)?

Calling late at night. Debt collectors can only call you between the hours of 8:00 a.m. and 9:00 p.m. In fact, they cannot contact you by phone at all if you write a letter to the collector requesting that they discontinue the calls.

Contacting third parties. It is a violation of the FDCPA for debt collectors to contact any person but you and your attorney. They cannot threaten to divulge to others any information related to your debt.

Using scare tactics. The law prohibits debt collectors from threatening physical violence against you or your family; cursing at you; or claiming that they will sue you or threaten to garnish your wages (unless they actually have the intention to legally do so).

Claiming falsehoods. Collectors and creditors cannot make any false or misleading claims to manipulate the debtor. This includes claiming to be an attorney or claiming your debt is more than it is.

How Can I Ensure My Rights are Enforced?

The best thing to do is to contact a student loan debt collection lawyer who is licensed in your state and knows the PA debt collection laws.

If you are struggling with student loan debt in PA and have received calls and correspondence from debt collectors, you should contact our office immediately. We can require all communication with your debt collection agency go through us and we can evaluate if you have a claim against them for violations of the FDCPA.

Completely ignoring the debt collectors is not wise, as they may eventually file suit against you. It is best to have an attorney involved before this potential outcome, as your required response is time sensitive. Tell us about your situation and we’ll provide a free student loan debt legal consultation.

No comments so far!

Leave a Comment